With constant uncertainty looming in modern markets, we offer our best strategies for risk management in the stock market, cryptocurrencies, and the greater US markets.

Last Updated: 12/10/2021

Determining a Strategy for Risk Management

In the world of digital finance, risk management is essential in the volatile industries of technology stocks and cryptocurrencies. In this article, we focus specifically on Stocks, ETFs and Market Indices. This article is brought to you by Digital Financial Market.

Stock Investing: Understanding the Market

When it comes to the US Economy, any given year has many profitable ventures. As a trend, the US economy is constantly growing by 9% per year. The challenge of investing is not to enter the market at a specific time, which could prevent passive profits. The true difficulty in risk management for your investment portfolio is to know how to identify and protect against Market declines.

Market Declines: A Word From the Experts

First, we will be examining a quote from one of the most successful investors in history. Peter Lynch has a reputation for incredible returns with a record of carrying the most profitable mutual fund in American history.

Peter Lynch once made a public speech specifically on the phenomena of Market declines. In this speech, he speaks a relevant statement on the topic.

“History repeats itself. About once every 2 years, the market falls 10%. And about every 6 years, the market is going to have a 25% percent decline. That’s all you need to know.”

Peter Lynch, Legendary Investment Manager

List of Recent Financial Crashes

Lets examine the historical data to prove this pattern in our financial economy.

- The 2000-2001 Dot Com Crash – Market down -25%

- The 2007-2008 Financial Crisis – Market down -30%

- The 2020 Covid Financial Crisis – Market down -25%

This timeline clearly confirms that roughly every 8-12 years, any investor can expect a major bear market that may be detrimental to your portfolio. These times of crisis actually become a huge buying opportunity for your investments.

However, many individual stocks can face bankruptcy and reduced earnings during a market crash. This is due to the sudden drop in stock valuation and available cash for businesses and individual consumers. Another common event of these crashes are Inflation and increased taxes.

Protecting Your Portfolio During a Market Decline

The best way to protect your portfolio when the aura of a market crash has appeared is to increase your cash position. This does not mean sell all of your shares, as there are many reasons to hold the shares of ETFs, Indexes, and individual stocks that you believe are resilient to bounce back from financial crises.

By having more cash on hand than you may normally have, you can profit by holding a cash position that will not lose value when the market crashes. With a large amount still invested in stocks and shares, you can still profit when the market continues to grow (in case the anticipated “crash” was just a false alarm).

When a bear market hits, it will be very obvious in the market data. With your portfolio down, this is not the time to sell ETFs or Index funds. It may be appropriate to sell stocks that you think may not survive a challenging market.

Search for indicators for market turnarounds because once the market stops dropping, it is time to buy, buy, buy.

A market correction is the perfect time to invest after the storm has passed. Patience is key to timing the market, and remember that keeping a considerable amount of available cash is key to preventing losses when the market is on its way down.

Recent Market Movements

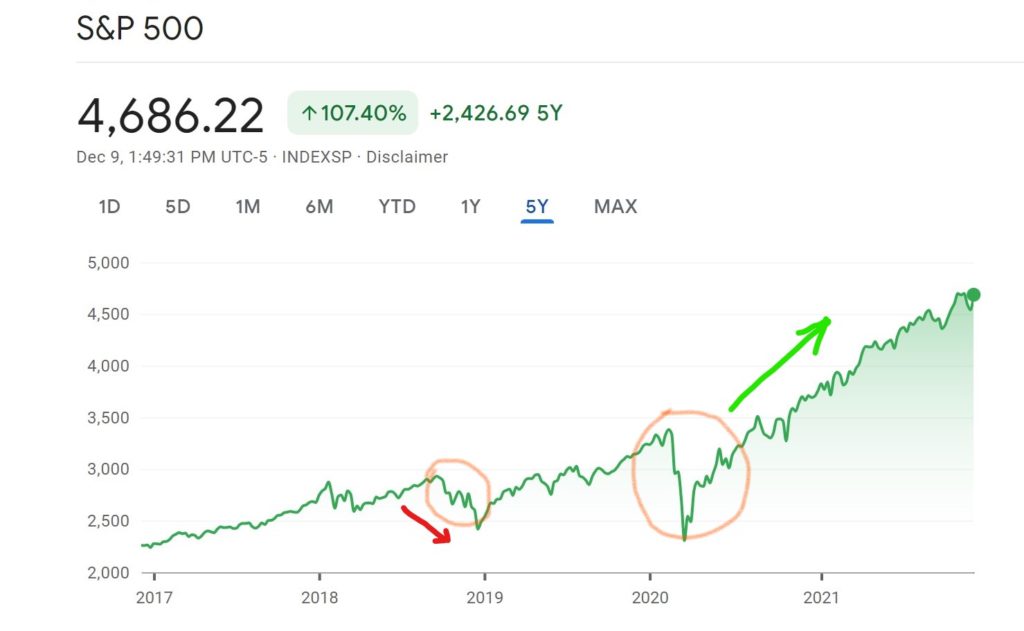

The chart below highlights the growth of the American Stock Market up until December of 2021, using the S&P 500 as a benchmark of the American economy.

As you can evaluate from the chart, Peter Lynch’s hunch about the pattern of a correction every 2 years and a crash every 6-8 years is accurate. This first red line indicates a 10% correction, while the second highlighted area indicates the 25% crash of the 2020 covid pandemic. Currently, we are due for a correction which may be evident in the recent market volatility in December 2021.

However, the United States is in a unique situation where the advancements in technology are so monumental that it is driving our economy to the greatest economic growth in this countries history. American tech companies Apple Inc. and Microsoft Corporation topped over $2 Trillion USD in market cap this year and are still seeing growth.

There is no direct answer for when the next correction will occur. However, we can prepare and anticipate patterns based off of Peter Lynch’s statements.

Expert Opinion: Billionaire Ray Dalio

Billionaire investor Ray Dalio is a renowned hedge fund manager that has a legendary record of carrying a positive return every single year, even throughout the market decline of 2007-2008. He is the founder of the multi-billion dollar company Bridgewater Associates and offered some valuable advice for the economy.

In December 2021, Ray Dalio stated that an abrasive trade war with China could result in a market crash. He suggests an in depth Risk Assessment to determine how to best approach a volatile market. Read more on Ray Dalio’s statement on a possible market decline in 2022.

Disclaimer: This article is not financial advice, but is instead a historical article that documents the market data and the opinions of qualified professionals.

Top ,.. top top … post! Keep the good work on !