We present a complete guide to understanding Solend (SLND) Crypto and it’s technology in the field of cryptocurrency development. We include helpful explanations, illustrated guides, historical data, and technical details. This article is brought to you by Digital Financial Market

Solend (SLND) Cryptocurrency

Solend is a Decentralized Finance lending platform built on the Solana Blockchain. The SLND token is the governance token for the network and is also earned as a form of interest on supplied cryptocurrencies.

On the network, users can lend out their cryptocurrencies to other users automatically using the Solend Protocol and earn interest. Using the stakes supply of tokens, they can borrow the same token or another cryptocurrency using their initial stake as collateral.

If the volatility of either the borrowed or lent token allows the borrow threshold to reach higher than 80%, then the account gets liquidated, and the user keeps all the token that they borrowed, but lose all the tokens that they lent.

This concept is an open-source DeFi principle where anyone can make an over-collateralized loans on cryptocurrencies and make payments in real-time.

See Solend DAO Official Website

Key Points of Solend

- Solend is a DeFi Lending platform for Crypto

- Solana-Based token, began in 2021

- Users can lend to others anonymously and with interest

- Over-collateralized crypto loans, with risks

Solend (SLND) Price Chart

Solend (SLND) Historical Price Chart

Solend Liquidation Crisis of June 2022

In mid-2022, an enormous wallet had supplied 5.7 SOL tokens ($170 Million at the time) to the Solend Main Pool, accounting for over 90% of the entire SOL supply for the platform. With this SOL as collateral, the wallet user had taken out $108 Million of USDC as a loan, which caused bottlenecks in liquidation that led to a temporary outage in USDC Withdrawals for all users.

For context, in of May and June of 2022, SOL had reached a recent drop to about $27, but was trading at about $37 at the time of the incident on June 20th, 2022.

The liquidation price for this loan was if SOL reached lower than $22.30. Vulnerable to the wild market swings that hit the crypto market all of 2022, Solend developers worried that this loan was far too risky and carried massive consequences.

Solend Faced An Outage That Prevented USDC Withdrawals

Developers anticipated that a liquidation of a position of that size would cause a cascading effect where SOL is rapidly liquidated to USDC in the millions. The community agreed that this would not only cause massive issues to the Solend Website, but it may cause a major outage on the Solana Network or even a collapse of the token value.

Solend Governance Controversy of 2022

As this position became rather complicated for the greater Solana community, the Solend Decentralized Autonomous Organization (DAO) decided to gather a community vote to mitigate the risk involved with this liquidation risk.

This proposal was named SLND1: Mitigate Risk From Whale, and took place over a short 2 day voting period. They detailed the issues at hand and their many attempts to reach the whale, claiming tweets, dms, and even on-chain messages on the Solana Network.

In the statement, the main solution proposed was that the users account be overtaken with emergency powers and managed by developers to secure the network and prevent a liquidation crisis or network outage.

Solend Stakeholders Use Voting Power to Overhaul Wallet

In this SLND1 Proposal, mixed sentiments were shared by users as some saw the whale as “degenerate gambling” or “putting us all at risk.” Others disputed the proposal, mentioning that “This goes against everything that is DeFi” and that the “A takeover of other peoples assets [was wrong].”

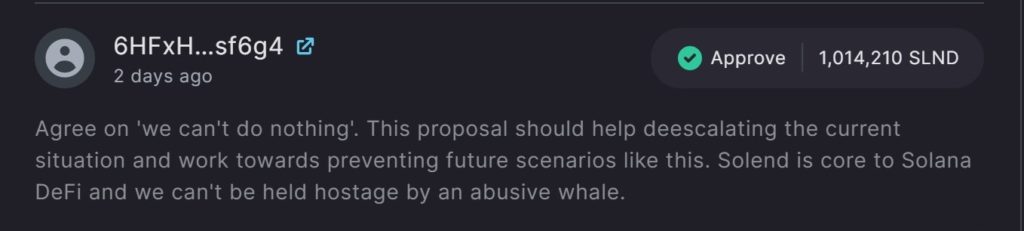

In this community vote, one user singlehandedly stole the vote by utilizing their 1 Million SLND wallet and claiming over 90% of the decision making power at the time. They commented on the risk presented by the whale by saying this:

One important point is that the decision came about from the SLND token Governance, meaning that the whole stake of 5.7m SOL presented no voting power in this decision aside from the meager SLND earnings yielded over time.

The vote deciding on such a massive matter concluded in only a 2 week mediation attempt. With the SLND token being the governance tool, this smaller roughly $1 Million stake immediately overruled a $170 Million lending supply and $108 USDC loan.

Solend DAO Decides to Reverse Wallet Takeover

An uproar of backlashes emerged from the community as this Solend Vote caused it to be the first platform to overhaul a wallet to mitigate risk and prevent disaster. Very quickly, the Solend Community drafted a swift and immediate reversal proposal called SNLD2: Invalidate SLND1.

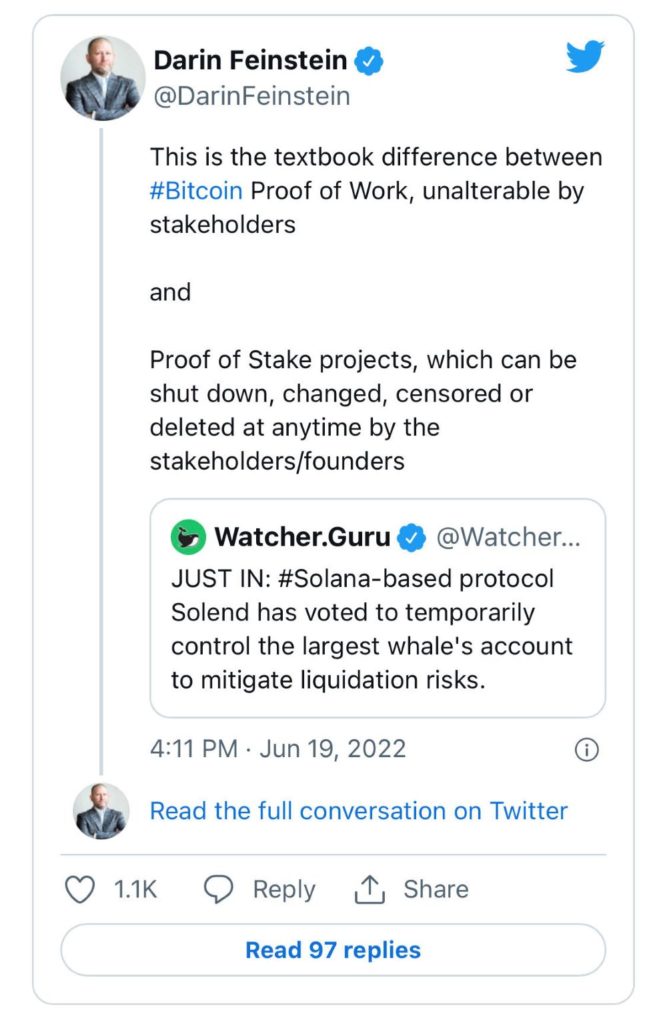

The decision of this one SLND holder suddenly and abruptly granted emergency powers that was intended to mitigate this extreme risk, however held an authoritarian “account freeze” resemblance. Many across all of crypto community spoke out with criticism:

Shortly after the outspoken response to the proposal approval, the Solend DAO had set the deadline of under 24 hours for the reverse decision. At this time, the outage ended and USDC withdrawals had finally become available again to stakeholder wallets.

Solend Creates Temporary Solution with Account Limits

After approving SLND2 with over 99% unanimous agreement, the community created a new proposal, SLND3: Introduce Account Borrow Limit, reducing account loan limits to $50 Million with gradual reductions over a short time. In addition, it temporarily adjusted liquidation limits to 99% from the prior 80% threshold.

At the time, the whale wallet took control and offloaded around $20 million worth of shuffled USDC debt and SOL supply, stabilizing the jeopardized protocol. This account limits solution was passed with over 99% approval, however the community recognized it as a “temporary solution where users could circumvent the borrow limit using multiple wallets.”

Developments in the Solend community are still ongoing.

Solend Controversy Still Stands

Many questions arise from the sudden and swift “account freeze” takeover that occurred rather suddenly in the world of DeFi. Should developers be given such capacity to mitigate network-wide problems?

Regulators and leaders have taken notice to the outcries of unstable crypto markets, and these conflicts have no simple answer in the rule of financial law. Many DeFi Leaders speak out to call this situation “unacceptable” and even “unlawful.”

Cryptocurrency conflicts lead to serious intervention, as governments around the world are making powerful decisions on whether these “Decentralized Organizations” stand as legal entities. With assets and risks amounting in the millions, Solend DAO may continue to face challenges ahead.

Nonetheless, their platform remains robust and is still live for Solana-based Wallets.

Solend FAQ

What Is Solend?

What Happened To Solend?

What Is Solend DAO?

How Do I Use Solend?

Solend Crypto Analysis

Is Solend A Good Investment?

What Is Unique About Solend?

What is SLND Coin?

What is Solend Crypto?

Images are sourced under Creative Commons Fair Use

Featured Image (Top) Is Rights Reserved